Malaysia Car Excise Duty Calculator

Excise Duties Order 2022. Classic cars with car age of more than 25 years.

Luxury Tax To Encourage People To Buy More Fuel Efficient Cars Ttautoguide Com

This means buyers of locally-assembled CKD cars will be exempted from paying the 10 percent sales tax upon purchase.

. 2022 to increase the Special Additional Excise Duty on production of Petroleum Crude and exempt export of Aviation Turbine Fuel. So register with us. However do note that other taxes like excise and import duties still apply.

The story has been updated accordingly. These rates can be quite high and excise duties can be up to 100 percent when importing a foreign vehicle. Or find your next car amongst the quality listings at otomy.

Excise Duties Exemption From Licencing Order 2019. For details about import duties and local taxes from the. Aside from the sales tax vehicles sold are also charged with other taxes namely excise duty and import duty.

35 of the CIF value or Ksh 5000 whichever is higher is payable. The Tax Free Threshold Is 500 MYR If the full value of your items is over 500 MYR the import tax on a shipment will be 10. 3 This makes most foreign cars extremely expensive for buyers although cheaper in other countries.

Import Duty is 25 of the Customs Value. 5 Free Calculations Per Day At Simply Duty you. KRA provide the current Retail Selling Price CRSP for your vehicle.

Car Tax Import duty must be paid on any vehicles imported into Malaysia. These taxes are also one of the highest in the world. Please complete information below.

The gazette adds new components into the OMV calculation. This calculation is as follows. Sales tax administered in Malaysia is a single stage tax imposed on.

Customs Value is the CRSP value with depreciation applied. It comes down to the total price though and this is affected by the excise tax. Its simple free and easy.

B Vintage cars with car age of more than 50 years. 2 of the CIF value. Duties taxes on motor vehicles.

Most of the countries have local taxes of less than 20 whereas Malaysia has. 16 of Customs Value Import Duty Excise Duty IDF. Every country is different and to ship to Malaysia you need to be aware of the following.

Laptops electric guitars and other electronic products. At present the excise duty is set at between 60 to 105 for both locally assembled and imported cars and it is calculated based on the car model and engine capacity. Excise Duties Order 2004.

25 of Invoice value Insurance Freight charges Excise duty. E-excise system and sales tax paid. Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antarctica Antigua and Barbuda Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Belarus Belgium Belize Benin Bermuda Bhutan Bolivia.

Road Tax Calculator Latest JPJ formula - calculate how much your vehicles road tax will cost. Fortunately vehicles from ASEAN countries are not imposed with import duty. Some goods are not subject to duty eg.

Value and Duty Description. These taxes cause a foreign car to cost almost three times or 200 more than. The Tax Free Threshold Is 500 MYR If the full value of your items is over 500 MYR the import tax on a shipment will be 10.

These excise duties imposed on foreign manufactured cars have made them very expensive for consumers in Malaysia. If you compare the actual price of the vehicle the amount that you would pay isnt too bad. On the other hand import duty can reach up to 30 depending on the vehicles country of manufacture.

Excise duties sales tax 1800 30 0 10 0 75 10 1800 - 1999 30 0 10 0 80 10. Duty Calculator Import Duty Tax Calculations Use this quick tool to calculate import duty taxes for hundreds of destinations worldwide. Malaysia Import Duty Calculator.

Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. Excise duty is between 60 and 105 regardless of CKD or CBU calculated based on the car and its engine capacity while import duty can reach up to 30 depending on the vehicles country of manufacture. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

Guide on Automotive Industry As at 23 August 2018. 20 of Customs Value Import Duty VAT. Excise Duty is 20 of the Customs Value Import Duty.

Exporting from which country. The Sales and Service Tax SST exemptiondiscount for new cars has been extended to 31-December 2021. Car Ownership Type.

Every country is different and to ship to Malaysia you need to be aware of the following. Excise Duties Sweetened Beverages Payment Order 2019. The excise duty import duty VAT and the IDF Fee are all calculated from the customs value.

Excise Duties Order 2012. Meanwhile the import duty can go up to 30 which varies. Excise Duties Order 2017.

Prices for CKD locally assembled cars will increase by between 8-20 if new excise duty regulations are put in place due to a change in methodology of how the open market value OMV of a. Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. When shipping a package internationally from Malaysia your shipment may be subject to a custom duty and import tax.

Meanwhile the import duty can go up to 30 which varies based on the vehicles manufacturing country. On top of sales tax depending on the car and its engine capacity excise duty is levied between 60 and 105. Vehicles from ASEAN countries are not imposed with import duty.

Passenger cars including station wagons sports cars and racing cars cbu ckd. Other motor cars malaysia. At present the excise duty is set at between 60 to 105for both locally assembled and imported cars and it is calculated based on the car model and engine capacity.

25 of the Customs value CIF of the vehicle ie. When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. Enter CIF Value in Rs.

I Taxable goods manufactured in Malaysia by any registered manufacturer. Engine Capacity cc Region.

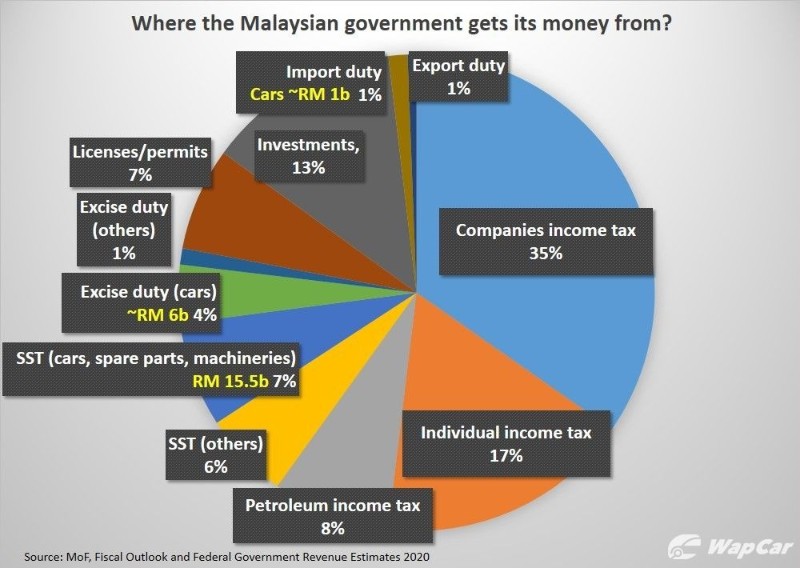

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

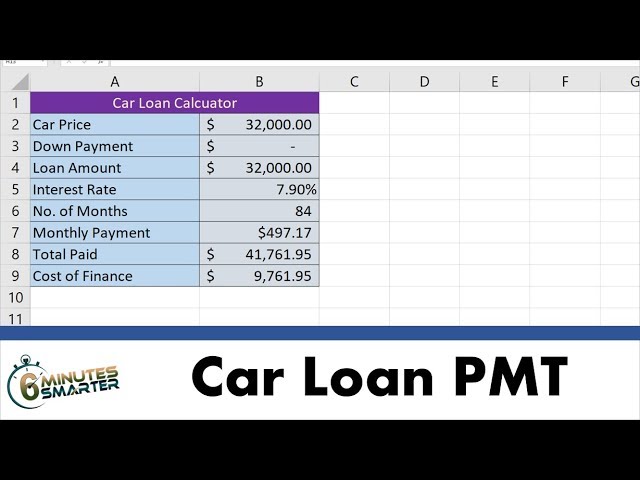

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Car Tax Calculator Calculate Your Car Taxes Car Insurance Cheap Car Insurance Inexpensive Car Insurance

0 Response to "Malaysia Car Excise Duty Calculator"

Post a Comment